Ready to use legal template

Drafted by experienced lawyers

Compliant with Indian law

Ready to use legal template

Drafted by lawyers

Compliant with Indian law

Home › Business contracts › Shareholders agreement

Learn more about Shareholders Agreement in India

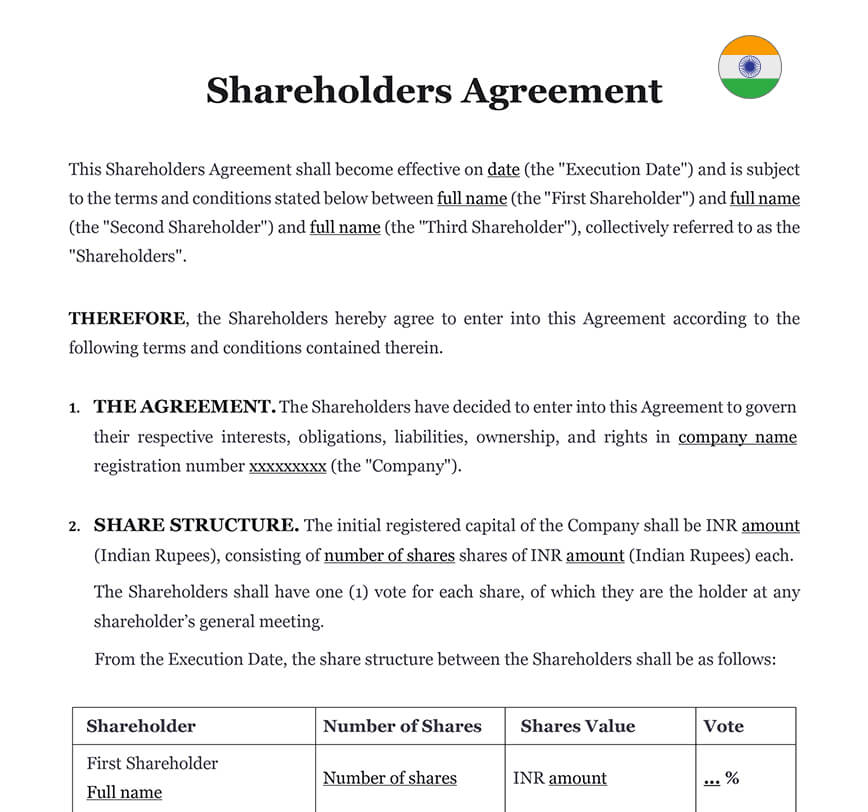

A Shareholders Agreement is a legally binding contract that defines the rights, responsibilities, and obligations of a company’s shareholders. It governs crucial aspects such as share ownership, voting rights, dividend distribution, decision-making processes, and dispute resolution. In India, this agreement plays a vital role in protecting shareholder interests, ensuring transparency, and preventing conflicts, especially in private limited companies governed by the Companies Act, 2013. By establishing clear rules on share transfers, exit strategies, and management control, a well-drafted Shareholders Agreement safeguards both majority and minority stakeholders. Download our professionally drafted Shareholders Agreement, fully compliant with Indian corporate laws and easy to edit in Word format, drafted by experts to provide clarity and security for your business.

Table of contents

-

What is a Shareholders Agreement?

-

What is the purpose of the contract?

-

What are the advantages of a Shareholders Agreement?

-

What are the disadvantages of the agreement?

-

What are the main clauses of the contract?

-

Is it necessary to contact a specialized lawyer?

-

Can a Shareholders Agreement be terminated?

What is a Shareholders Agreement?

The shareholders of a company may decide to sign another legal document in addition to the articles of association, the shareholders’ agreement. This so-called “extra-statutory” agreement sets out certain rules relating to the functioning of the company and to relations between shareholders. The articles of association and the shareholders’ agreement are therefore two very different things and should not be confused: while the articles of association are the founding document of the company, the agreement completes them and adapts their operation.

By specifying certain rules concerning the organization and operation of the company, the shareholders’ agreement makes it possible to settle certain questions in order to avoid disagreements and anticipate conflicts. Thus, it also guarantees more security for the shareholders by stabilizing their relations. The drafting and conclusion of such a document allows to ensure a certain balance between divergent interests, or sometimes simply to reinforce the protection of common interests. It can be signed by all the shareholders or only by some of them.

It is common to hear the terms “Partnership Agreement” and “Shareholders’ Agreement” used as if they were synonyms. The difference between these two agreements lies in the legal form of the company concerned. Indeed, one speaks of a shareholders’ agreement in joint stock companies such as public limited companies or simplified joint stock companies. On the other hand, private limited companies, civil companies and other partnerships are referred to as partners’ agreements.

What is the purpose of the contract?

The main objective of the shareholders’ agreement is the management of relations between the shareholders, whether to prevent conflicts or to distribute powers between them. Indeed, disputes may arise during the life of the company and if no shareholders’ agreement resolves the contentious situation, the partners could quickly find themselves in a deadlock. It can also provide for specific management rules for the company or limit the powers of the directors.

In practice, it is an instrument often used during business takeovers. It is also useful in the context of the acquisition of shares by investors, an operation in which the majority shareholders are often called upon to make commitments to the investors. The shareholders’ agreement is a very useful tool for companies, but it can suffer from certain limitations and therefore has both advantages and disadvantages.

What are the advantages of a Shareholders Agreement?

In the context of the creation or life of a company, the conclusion of a shareholders’ agreement can quickly prove to be useful and necessary.

One of the main advantages of the agreement is its discretion. It is not published in the Journal Officiel and can therefore contain clauses that one wishes to keep secret. As this act is confidential, neither third parties nor even non-signatory shareholders can know its content.

Secondly, because of its specificity, the agreement allows settlement of particular situations, specific to certain partners. It may also contain clauses intended to apply for a limited period of time, which is not possible with the company’s articles of association, which are intended to govern its organization for the entire life of the company. Another interesting element is the great freedom it offers to its members. Thanks to the principle of contractual freedom, shareholders enjoy a great deal of leeway.

What are the disadvantages of the agreement?

The shareholders’ agreement also has certain disadvantages. Indeed, its effectiveness is limited. Since it is unknown to third parties, the shareholders’ agreement has no effect on them and cannot be enforced against them. In the same spirit, the agreement is not binding on non-member shareholders. This is the relative effect of agreements, which means that the agreement is only binding on the parties to it.

In addition, in the event of a breach of the covenant, the shareholders can generally only hope to claim damages. If enforcement is possible, it does not concern all clauses and is only rarely ordered. Finally, the wide margin of flexibility left to the partners may also constitute a disadvantage insofar as it makes the drafting of the agreement complex.

What are the main clauses of the contract?

The content of a shareholders’ agreement can be extremely varied. The shareholders are free to insert a wide variety of clauses. This flexibility is the result of contractual freedom. Although the list is not exhaustive and the possibilities are endless, two categories of clauses can be distinguished: general clauses and specific clauses.

General clauses are the clauses generally inserted in agreements. For example, in shareholder agreements, as in most business contracts, a confidentiality clause is frequently inserted. Its purpose is to impose an obligation of discretion on the members of the agreement. The same is true for the non-competition clause, which is intended to prohibit the signatories from competing with the company, and the penalty clause, which will have the effect of encouraging the members to fulfil their commitments by providing for a particular penalty in the event of non-fulfilment.

In addition to these general clauses, the shareholders’ agreement also contains specific clauses. These are also very diverse. The specific clauses are clauses relating to specific questions, such as the management of the company, the shareholding, the exit of a shareholder or the termination.

In terms of company management, the most frequent clause is the voting clause, which organizes the voting rights of the shareholders for listed decisions. As for clauses relating to shareholding and transfers of securities, they allow to protect certain shareholders and to control the stability of the shareholding.

Secondly, the clauses relating to the exit of a shareholder govern the situation in which a shareholder wishes to leave the company. This is indeed an important event, which often occupies a prominent place in the pact. On this point, one thinks in particular of the pre-emption clauses, which are intended to give the shareholders the right to buy the shares in priority in the event of a transfer.

Finally, the clauses relating to the termination of the agreement. The purpose of break clauses is to allow one of the signatories to sell his shares and leave the company, and therefore the shareholders’ agreement. Indeed, it is necessary to establish upstream whether the agreement provides for a joint exit clause or a priority exit clause for the shareholders.

Is it necessary to contact a specialized lawyer?

It is strongly recommended to call upon a lawyer specialized in business law to draft and conclude a shareholders’ agreement. Indeed, although the content of the agreement remains extremely free, it is impossible to derogate from certain rules, in particular those of public order. The agreement may not be contrary to the corporate laws or the Articles of Association. The relationship between the latter and the agreement can sometimes be complex.

Moreover, although the shareholders’ agreement offers flexibility to its signatories, the great freedom they enjoy and the immense diversity of types of agreements can sometimes complicate its drafting. It is therefore preferable to turn to a legal professional to ensure that it is properly drafted and valid.

The assistance of a Themis Partner specialized lawyer can thus ensure that the agreement is in line with the objectives for which it was concluded. The lawyer will be able to advise you on the clauses to be inserted or not, and will propose you a personalized agreement, in conformity with your needs as well as the particularities of your company.

Can a Shareholders Agreement be terminated?

The terms and conditions for breaking the shareholders’ agreement are specified in the clauses provided for this purpose. The breach of the agreement occurs, for example, in the event of a joint exit, the exclusion of a partner or a forced exit through the purchase of the shares of minority partners. Non-compliance with the shareholders’ agreement also leads to the breach of the agreement, as it is a breach of the commitment.

The violation of the shareholders’ agreement is not as serious as the violation of the articles of association. The shareholders’ agreement binds only its signatories and cannot be invoked against third parties. The agreement may provide for a financial penalty in case of violation of the agreement.

SPECIAL OFFER

Startup

15 Document Package

Essential documents for running your business in India

Shareholders AgreementTemplate (.docx)

Save on attorney fees

310 client reviews (4.8/5) ⭐⭐⭐⭐⭐

Share information

Why Themis Partner ?

Make documents forhundreds of purposes

Hundreds of documents

Instant access to our entire library of documents for India.

24/7 legal support

Free legal advice from our network of qualified lawyers.

Easily customized

Editable Word documents, unlimited revisions and copies.

Legal and Reliable

Documents written by lawyers that you can use with confidence.