Ready to use legal template

Work on without any hassle

Compliant with Indian law

Ready to use legal template

Work on without any hassle

Compliant with Indian law

Home › Rent your property › Rent receipt

Learn more about Rent Receipt in India

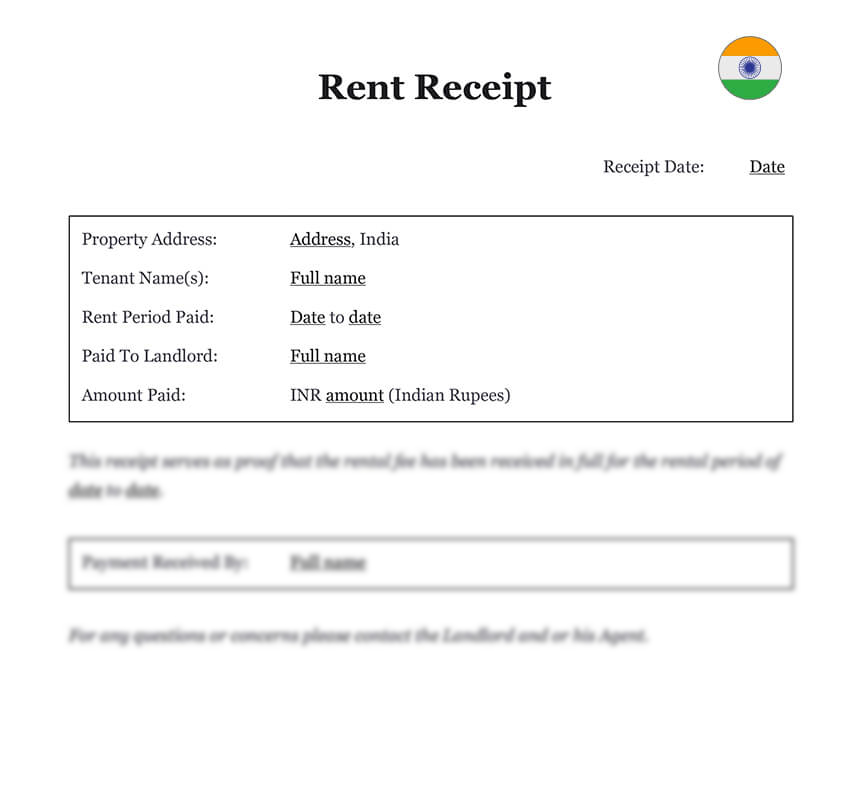

A Rent Receipt is a formal document used to acknowledge the payment of rent from a tenant to a landlord in India. It serves as essential proof of payment for both parties and is often required for income tax deduction claims under Section 10(13A) of the Income Tax Act. For landlords, it supports clear rental records and helps avoid future disputes. Whether it’s for residential or commercial use, a properly issued rent receipt is a key part of professional property management. In India, it’s standard practice to issue receipts monthly. Download our Rent Receipt template, fully editable in Word format and designed to meet the common rental documentation needs in India.

Table of contents

What is a Rent Receipt?

A Rent Receipt is a document that details the payment of rent for a specific time period. A landlord is responsible for issuing and retaining a copy in her records in case of a dispute. Rent receipts should be kept in a secure location by tenants. Tenants might request receipts if their landlord does not provide them on a regular basis.

The rent receipt proves that the landlord received the rent and can be used as proof if the landlord claims that the rent was not paid. The paperwork should include the date, amount, recipient’s name, and tenant’s name. If there are any unusual conditions, such as a rent decrease, these should be explicitly indicated on the receipt. This can be useful in the future, since the tenant can present the record to demonstrate how and why a payment history contains unexpected entries.

What is included in the Rent Receipt?

Tipically, a Rent Receipt includes:

| ➤ Tenant's Surname |

| ➤ Landlord's Name |

| ➤ Payment Amount |

| ➤ Payment Date |

| ➤ Rental Period |

| ➤ House Address (Rented Property) |

| ➤ Signature of Landlord or Manager |

| ➤ The Landlord's PAN (not mandatory, mention only if annual rent exceeds Rs.1,00,000 in a year) |

| ➤ Stamp of Revenue (where amount exceeding Rs. 5000 is paid in cash) |

| ➤ Payment method (cash, credit card, money order, cashier's check) |

| ➤ Payment includes services or other expenses (e.g. utilities, security deposits, convenience fees) |