Ready to use legal template

Work on without any hassle

Compliant with Indian law

Ready to use legal template

Work on without any hassle

Compliant with Indian law

Home › Accounting › General receipt

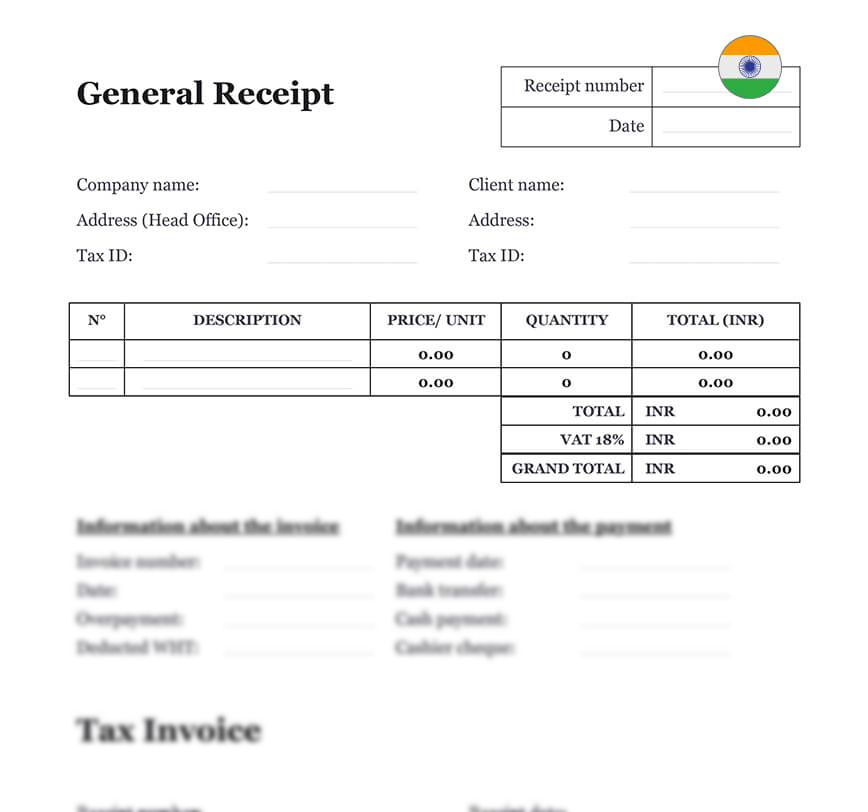

Learn more about General Receipt in India

A General Receipt is a versatile document used to confirm receipt of payment for goods, services, donations, or any financial transaction in India. It serves as official proof of payment and helps maintain transparency in personal and business dealings. Whether you’re a freelancer, business owner, or NGO, issuing a general receipt builds trust and supports your accounting and GST compliance. In India, proper documentation of transactions is essential for audits, tax returns, and regulatory compliance. Our General Receipt template is easy to edit in Word format and can be used across various industries and purposes. Download it today to simplify your payment acknowledgments and keep your financial records organized.

Table of contents

What is a General Receipt?

A Payment Receipt is a private document in which it is stated that the product or service has been paid in full or in part.

Since the payment receipt is made after the debtor has discharged his obligation, it operates as proof of discharge of the payment debt. This allows for a bipartite acknowledgement, i.e. between the creditor and the debtor, that the buyer or the person receiving the service is no longer liable. This document is therefore important to assert or oppose a debt of payment.

Receipts are an integral part of the daily life of any company, entrepreneur or individual. They allow to keep the proof that the company has paid for the product received or the service rendered. Thus, the invoices issued are marked with the mention “paid” to the accounting department thanks to these receipts. These receipts are therefore crucial for the company’s accounting. It is therefore important that the receipt you use is as complete and correct as possible.

What information must be included on the Payment Receipt?

In order to issue a receipt, certain criteria are required. Here is a list of items that must be included on your receipt:

| ➤ The title "receipt" |

| ➤ The reference number of the invoice, product, or other |

| ➤ The total amount, net and gross |

| ➤ Method of payment (cash, bank transfer, credit card or check) |

| ➤ Name and address of the issuing entity |

| ➤ Name of the recipient |

| ➤ Quantity and description of the products sold or the service provided |

| ➤ Place and date |

| ➤ Signature of the Director of the company and stamp of the company |