Ready to use legal template

Work on without any hassle

Compliant with Indian law

Ready to use legal template

Work on without any hassle

Compliant with Indian law

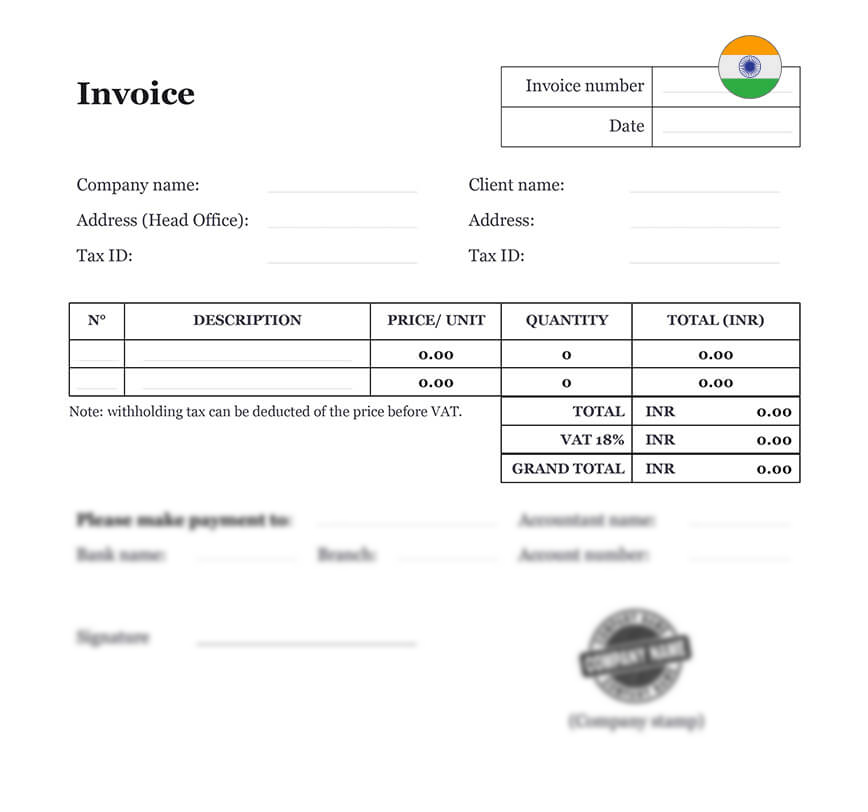

Home › Accounting › Invoice

Learn more about Invoice in India

An invoice is a formal document issued by a seller to a buyer, outlining the products or services provided, their costs, and the payment terms. It serves as a record of the transaction and is crucial for bookkeeping, tax reporting, and ensuring transparency between business parties. In India, invoices play a key role in complying with Goods and Services Tax (GST) regulations, as they are essential for GST filings and maintaining accurate financial records. Properly issued invoices help businesses avoid tax issues, streamline payments, and facilitate smooth transactions. Whether you run a small business or a large corporation, having a well-structured invoice is essential for maintaining financial clarity and compliance. Download our Invoice Form, easy to edit in Word format, tailored for use in India.

Table of contents

How to make an Invoice?

Creating, issuing, and managing invoices is a crucial element of running a business and is required for a consistent cash flow. As a result, it is critical for all entrepreneurs to understand how to prepare an invoice and the fundamental parts of an invoice.

Invoice Format

The buyer can get an invoice in either electronic or paper form. The government has made no specific format requirements. However, all invoices must include the basic information specified above, as required by law. Furthermore, all invoices must be serialized, and the same serial numbers may not be used on more than one invoice.

Invoicing Best Practices

Invoices can be issued in triplicate, with an original for the customer, a duplicate for the transporter, a triplicate for the supplier, and an extra copy if necessary. All invoices must be accompanied by the buyer’s purchase order, packing list (if applicable), and delivery challan. The invoice must be validated by a supplier authorized signature.

Is Invoice important in India?

In order to specify the commodities or services given and the rates applicable to various stakeholders, an invoice must be created. In order to collect money from a consumer, account for sales, prepare financial statements, and pay taxes to the government, an invoice is necessary. Invoices can also be used to seek input service tax or VAT credit as a supporting document for a registered dealer.

What is included in the Invoice?

All invoices must include the following components:

| ➤ Supplier's name, address, and registration number (service tax, VAT, or others) |

| ➤ Buyer's name, address, and registration number |

| ➤ Date of invoice |

| ➤ Nature of goods or services supplied or rendered |

| ➤ Quantity of goods or services supplied or rendered |

| ➤ Value of goods or services supplied or rendered |

| ➤ Rate of taxes (service tax, VAT, or others), as applicable |

| ➤ Discount offered, if any |

| ➤ Total amount excluding taxes |

| ➤ Total taxes to be paid |

| ➤ Total sum including taxes |